We are long-term value investors

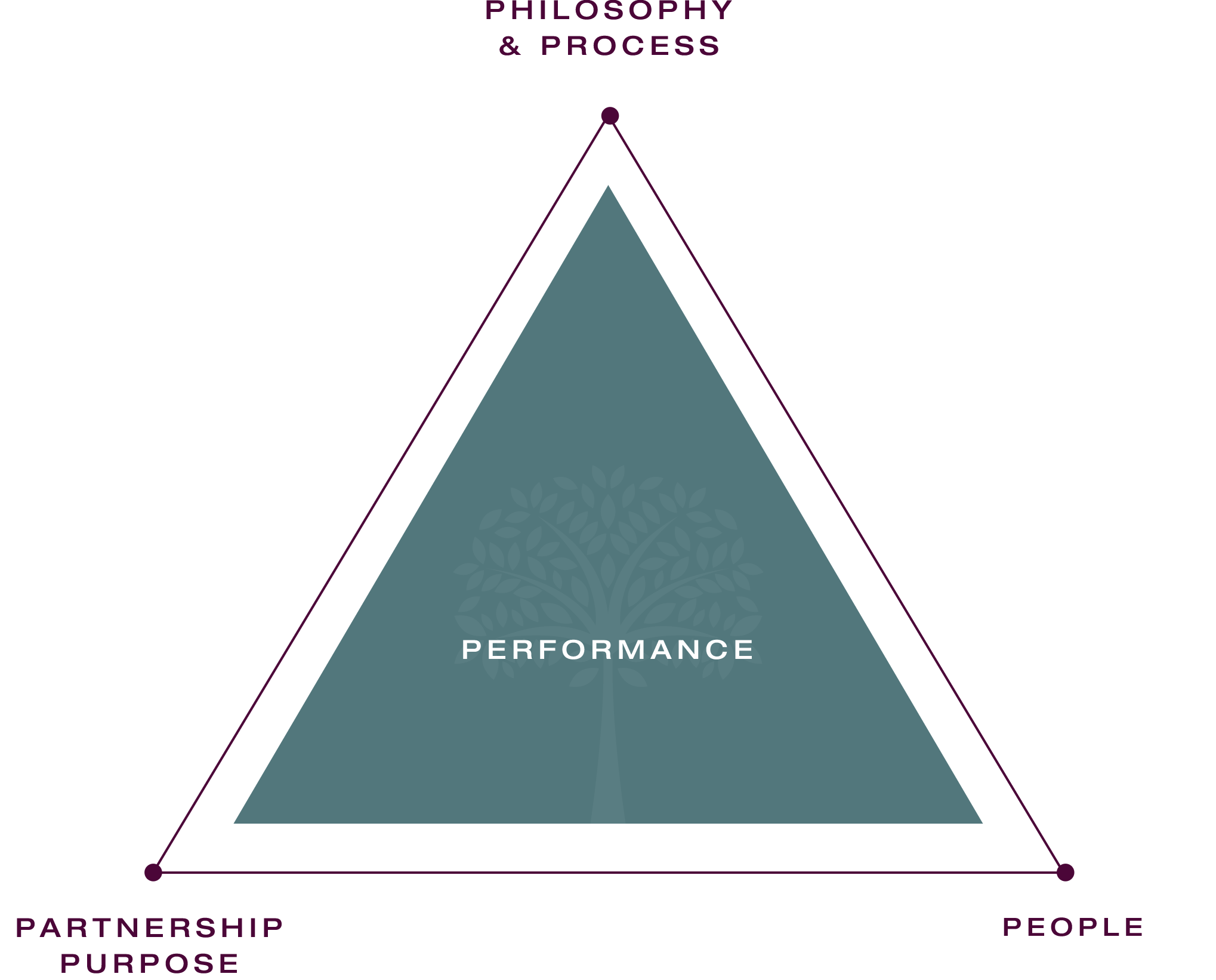

PHILOSOPHY & PROCESS

We are bottom-up, contrarian value investors. Our deep research process focuses on analyzing companies to ascertain intrinsic business values. We seek opportunities where market expectations diverge from these values.

PEOPLE

We are a team built with curious, independent thinkers creating an open culture where debate is relished and the where the whole is greater than the sum of its parts.

PARTNERSHIP PURPOSE

We put our partners first, always. Our purpose is to help clients achieve the best possible investment outcomes. We invest alongside our clients.

PERFORMANCE

Achieving superior investment outcomes is our ultimate goal. We believe our process, people and purpose create the conditions that will allow us to outperform over the long term.

OUR INVESTMENT PHILOSOPHY

Our investment approach revolves around five main principles:

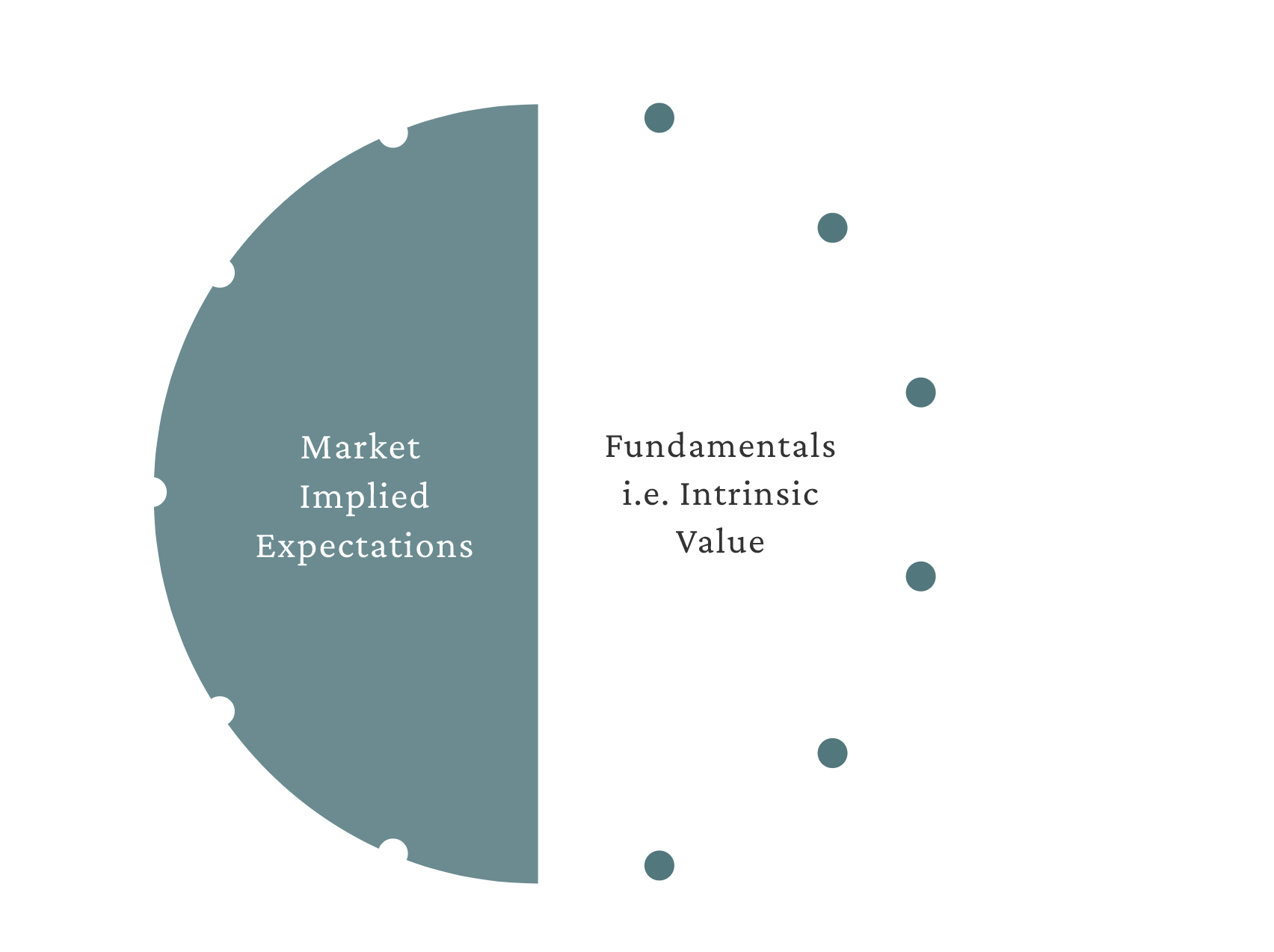

Valuation

We are valuation-based.

We value businesses by looking at a combination of fundamentals, strategy, peers, management and capital allocation to determine what a business is worth. We then compare our assessment of intrinsic value to the current price and invest when we believe the intrinsic value is significantly higher than the current price. We also translate observable market prices into embedded expectations for specific fundamentals and determine whether those expectations are reasonable.

Time Arbitrage

We invest for the long term.

We believe that investors are increasingly taking a short-term view and trading stocks from quarter to quarter. We focus on factors that are central to long-term performance throughout our process. Investing with a longer time horizon plays a significant role in what we view as our competitive edge.

Contrarian

We are contrarian by nature.

We look for investment opportunities during periods of uncertainty, typically investing in businesses, industries and sectors that are out of favor with current market sentiment. We think there are three sources of edge in markets – informational, analytical and behavioral. The most enduring of these three is behavioral, as humans tend to react emotionally, especially during abnormal and volatile times. As a result, we tend to see the greatest investment opportunities when markets are in a state of panic.

Nontraditional

We value nontraditional inputs.

Intellectual curiosity, adaptive thinking and creativity are important parts of our investment process. Our team stays current with numerous nontraditional resources, such as academic and literary journals in the sciences. We have also been involved in the Santa Fe Institute for more than 20 years. Incorporating nontraditional inputs into our research and process allows us to view businesses and situations from perspectives that others may not.

Flexibility

We believe flexibility is key.

Constraints almost always, by definition, impede solutions to optimization problems. Our Strategies are characterized by their unconstrained formats, and each attempts to maximize the long-term risk-adjusted returns for our investors.

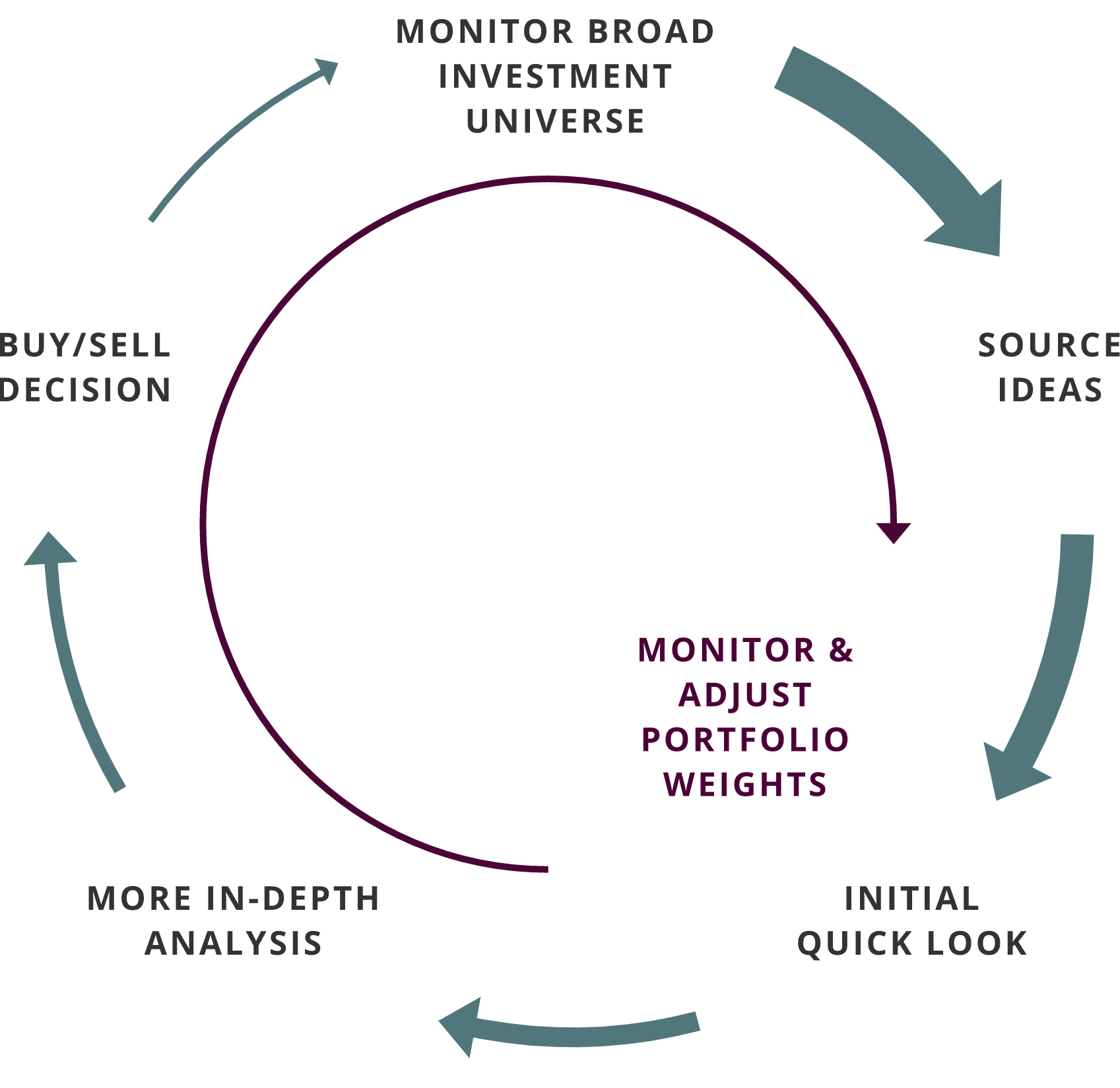

OUR INVESTMENT PROCESS

We source ideas systematically, considering out-of-favor sectors, industries, and companies.

We analyze factors that affect a company's free cash flow, the core to our understanding of a company's intrinsic value.

We build concentrated portfolios from the bottom up based on our assessment of return/risk factors.

We view volatility opportunistically and believe it is often the price you pay for long-term returns.