Read our latest blog

ABOUT PATIENT CAPITAL

- Bill Miller

Current Thinking

Insights

View All

Our Approach

See Our Approach

01

Returns-Focused

02

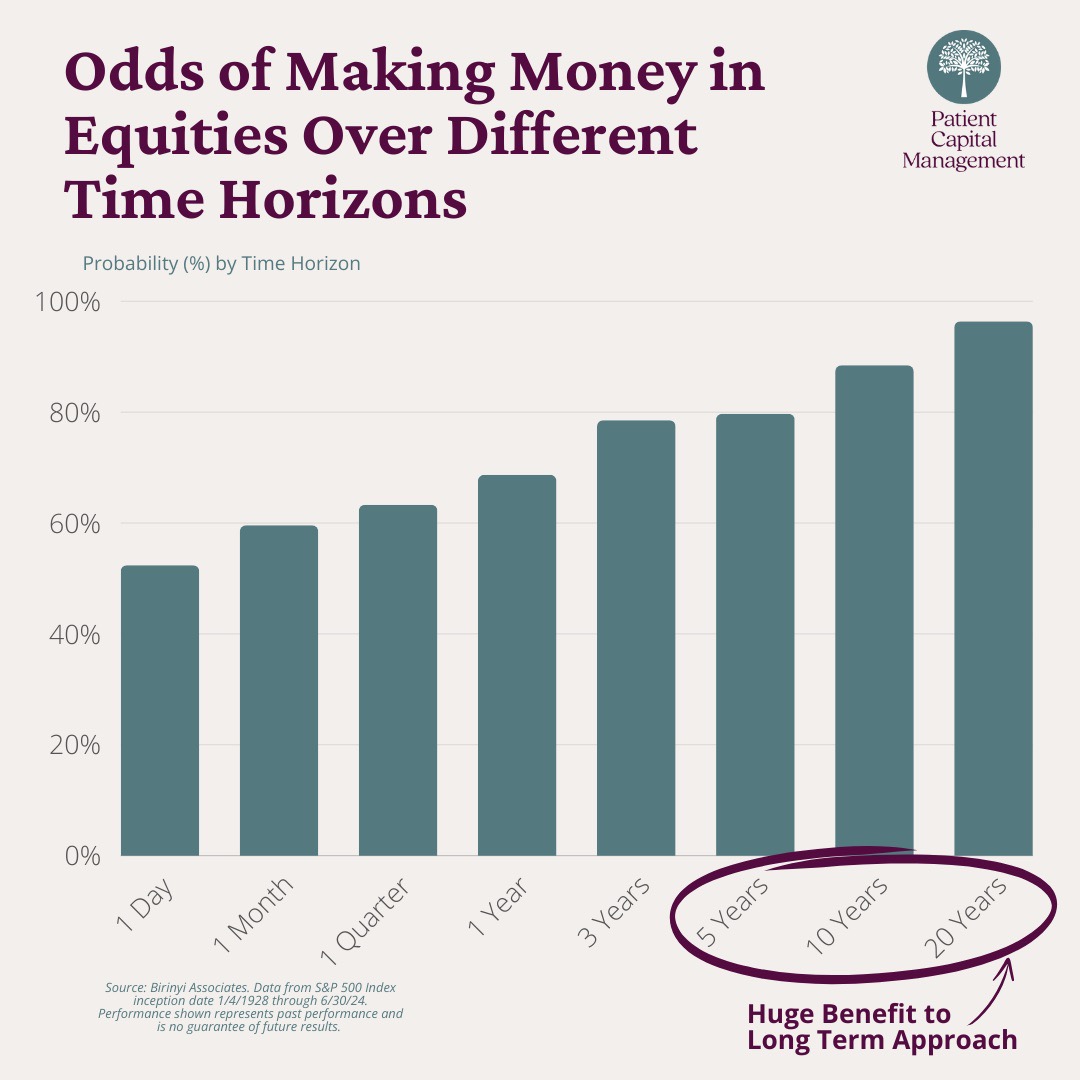

Long-Term

03

Fundamentals vs Expectations

04

Flexible

05

Valuation

06

Bottom-Up

Portfolio Contruction

Our Offerings

WE STRIVE TO HELP INVESTORS REACH THEIR FINANCIAL POTENTIAL

Mutual Funds

Mutual Funds

Mutual funds for investment accounts, IRAS, or 401K plans/rollovers for individual investors.

Individual Investors

Individual Investors

Investment strategies aimed to compound capital over the long-term.

Institutional Investors

Institutional Investors

Investment management for pension plans, foundations, endowments, other institutional investors and their consultants.

Get In Touch

FOR ANY INQUIRIES, CONTACT PATIENT CAPITAL MANAGEMENT

Contact Us