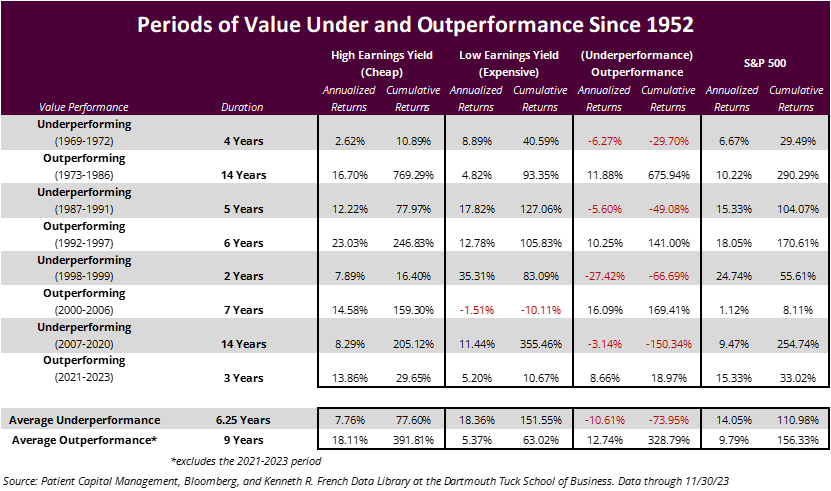

All data sourced by Patient Capital Management, Bloomberg, and Kenneth R. French Data Library at the Dartmouth Tuck School of Business.

The portfolios are constructed at the end of June. E/P is earnings before extraordinary items at the last fiscal year end of the prior calendar year divided by Market Cap at the end of December of the prior year.

Annual returns are from January to December.

Cheap: highest quintile of E/P

Expensive: lowest quintile of E/P

The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses, or sales charges. Earnings Yield (or E/P) is the inverse of the P/E ratio. Earnings yield is one indication of value; a low ratio may indicate an overvalued stock, or a high value may indicate an undervalued stock.

The views expressed in this commentary reflect those of Patient Capital Management analyst(s) as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results.

©2024 Patient Capital Management, LLC

Share