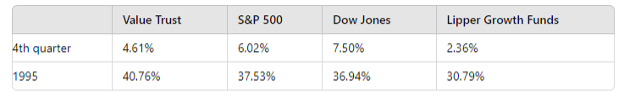

Your fund had an excellent year in 1995, rising 40.8%. Our results exceeded those of the S&P 500, the Dow, and all of the major equity fund indices. The details are:

Last year was an exceptional year for stocks as all of the key drivers to equity prices were positive: Interest rate fell sharply at the long end, and the Federal Reserve Board began to lower short-term rates over the summer. Corporate profits rose strongly as the economy exhibited solid growth with modest inflation.

It is often difficult for actively managed funds to outperform strongly trending markets. Last year most growth funds significantly underperformed, the result of staying too long with cyclicals and technology, the year's early leaders, and being underexposed to financials, which were among the best performers.

We have long held a major position in financials, believing them to be severely undervalued in an environment of low inflation and moderate growth. Although most investors recognize that inflation is unlikely to be a problem, that nominal GDP growth will tend to be 5% or less, that bank balance sheets are strong and financial stock valuations low, they persist in the fruitless endeavor of trying to time interest rate swings or changes in the momentum of earnings, or margins, or loss reserves. We have elected to ignore the temporary swings of sentiment and have concentrated on those companies' long-term value, a stance which has proven quite rewarding since financial stocks bottomed in 1990.

After their strong performance in 1995, financials came under selling pressure in the first few weeks of 1996 by investors (more accurately; by short-term traders and speculators) as long rates backed up to over 6%. This selling has slowed considerably since CITICORP announced earnings above expectations, raised its dividend 50%, and authorized an expanded stock repurchase program. The results announced by CITICORP, CHASE MANHATTAN, and CHEMICAL BANK stand in stark contrast to the disappointing earnings of Motorola, Intel, and Wal Mart, all favorites of the growth and momentum crowd.

Earnings disappointments in these big, visible growth stocks provide an early line in 1996. Last year the key question was interest rates; we knew earnings were going to be okay. If rates could come down in 1995, stocks were likely to go up. This year the issue is earnings, or more precisely, earnings momentum.

The consensus is that the economy is slowing, that the direction of interest rates remains lower, and that corporate earnings are likely to be up in the 5-8% range. Growth in general is estimated to be 2-2.5% for 1996. This would lead to stocks providing a total return of about 9-10%, or roughly in line with their long-term historical average. This was our thinking as well, up until a few weeks ago.

We now believe that the consensus estimates for economic growth and corporate profits are too high. In the fourth quarter the GDP may have expanded less than 1%, providing little momentum as we enter the new year. The continuing budget stalemate in Washington means that government finances are getting off to a slow start, and companies are already beginning to issue profits warnings as reduced government business. The powerful winter storms that swept the East Coast in January disrupted business activity generally and retail sales in particular. Finally, we are hearing from companies that business is at best sluggish, and pricing power non-existent.

It looks now as if the economy may only expand at 1-1.5% this year, and that corporate profits will disappoint the optimists. In this kind of environment, short-term interest rates are likely to move sharply lower and long-term rates modestly lower. We think that short-term interest rates could be about 4% by year end, with long rates between 5.25% and 5.75%. If we are wrong, we think it will be because rates are even lower. Inflation should remain quite subdued.

With profits under pressure, the heavy lifting in the stock market will have to come from interest rates. If the Federal Reserve is too cautious about reducing rates, stocks could have a moderate correction if earnings fears begin to become more widespread. In general, though, we think the environment for financial assets looks fine. We believe stocks will again outperform bonds and cash.

The equity environment will also be affected by what promises to be a lively election year. Despite the rancorous debate about budget policy, the direction of Federal expenditures as a percentage of GDP is clear: lower. The government is 25% of GDP and has a huge impact on the economy and markets. What goes on in Washington matters. Perhaps the most interesting early development this election year is the surprising strength of Steve Forbes in the Republican Presidential field. His advocacy of a 17% flat tax to replace the current income tax system is producing a healthy debate on how the government ought to satisfy its revenue needs.

The Forbes flat tax is one of several dramatic alternatives to the tax code currently floating around. Whatever its ultimate merits, it would be a major positive to capital markets, since it exempts the returns from savings and investment: from taxation at the individual level (they would still be taxed at the corporate level). This raises the after-tax return on investment and, other things equal, would sharply boost investment and the stock market, while lowering interest rates. If the Forbes message catches on, 1996 could be a surprisingly strong year for the markets.

We made only a few changes in the portfolio in the past quarter. They are listed elsewhere in this report. The fund remains tightly focused, holding only about 40 stocks, considerably fewer than other funds our size. This permits us to concentrate our research efforts. Right now our attention is directed to the much-battered technology sector, which we believe is a developing value. We increased our holdings in IBM a few weeks ago when the price dipped into the 80s, and we have initiated a position in NOKIA, a producer of cellular phones, whose stock has plunged from over 70 to the mid 30s. We think the company now represents solid value at around 10x earnings.

As always, we appreciate your support and welcome your comments.

Bill Miller,

CFA February 5,

1996 DJIA 5407.59

Share