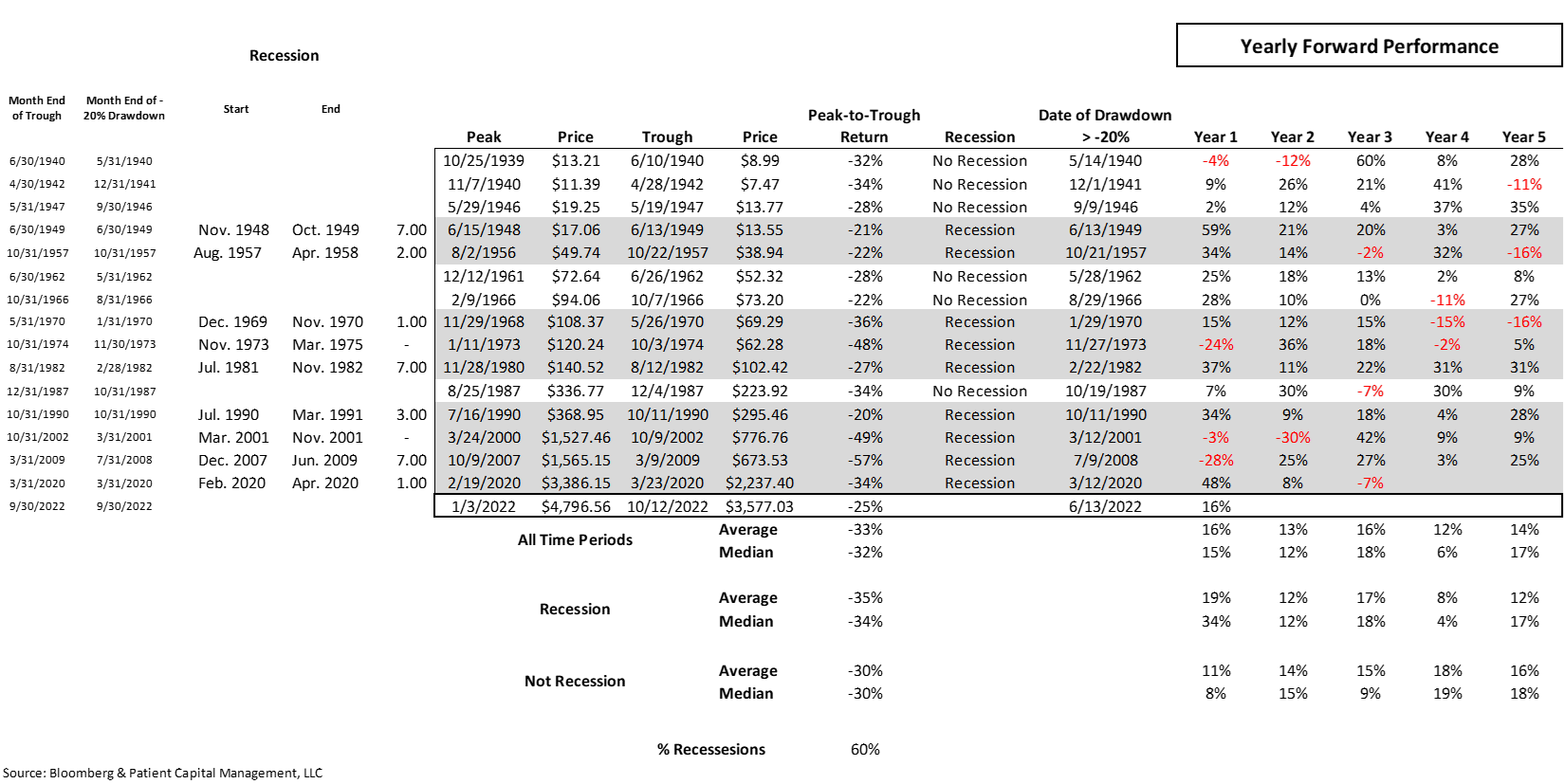

We strive to be rational, and data data driven. We examined historical bear markets to glean any possible wisdom about forward return prospects. The data indicated much more optimism than the prevailing wisdom. Our historical analysis showed that after entering a bear market, the market returned an average of 16% over the next year. Amazingly, the market returned that exact amount in the year after first entering a bear market. It posted a 22% gain from the June lows when we published the piece.

Now, we’ve officially entered a new bull market, conventionally defined as a 20% gain from the lows. Markets continue to climb a wall of worry, with many leading investors and strategists maintaining a bearish stance. Interest rates, inflation, recession, and geopolitics remain the biggest concerns. Strategists and economists we respect and admire have noted it is not unusual for it to take a year after a yield curve inversion for a recession to hit.1

Again, we ask: what does historical data suggest (data below)? Interestingly, after a bear market, there is no precedent going back over 8 decades for negative returns in the second year following a positive first year. Any time we suffered losses in the second year after a bear market, it was a continuation of losses from the first year. On average, the S&P 500 gained 13% in the second year following a bear market, a smidge better than the 12% median annual returns for the period.

Small sample size caveats exist, and of course anything can happen in markets. Bill Miller likes to remind us that “no one has privileged access to the future.” The best we can do is reason inductively and think probabilistically. The message from markets and from history implies further upside potential.

As Sir John Templeton said, “bull markets are born on pessimism, grow on skepticism, mature on optimism, and die on euphoria.” Let the skepticism continue!

1 U.S. Department of the Treasury, Daily Treasury Par Yield Curve Rates.

Source: Bloomberg.

Market Proxy is S&P 500. Returns greater than 1 year are annualized

The views expressed in this commentary reflect those of Patient Capital Management portfolio managers as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. These views are not intended to be a forecast of future events, a guarantee of future results or investment advice. Because investment decisions are based on numerous factors, these views may not be relied upon as an indication of trading intent on behalf of any portfolio. Any data cited herein is from sources believed to be reliable, but is not guaranteed as to accuracy or completeness

©2023 Patient Capital Management, LLC

Share