Rates moved higher as inflation appeared stickier than hoped, with the US 10-yr yield moving back to 4.2% after falling under 4% at the end of the year. Core PCE inflation came in at 2.8% YoY in February, up 0.3% from January, while 3-month annualized Core PCE moved higher to 2.6%. Meanwhile the Federal Reserve Money Supply M2, continued to stay in negative territory for the 15th month in a row. The Fed continued to hold short-term rates steady, but with the unemployment rate moving higher to 3.9% in February, the market is still expecting rate cuts to begin in June.

The S&P 500 gained 10.6% on a total return basis for the quarter. Unlike last year, the path was one of the smoothest, with a maximum drawdown of only 1.7% during the period. The market ended the quarter hitting its 22nd all-time high in the quarter, the highest number of record closes to start a year since 1998.

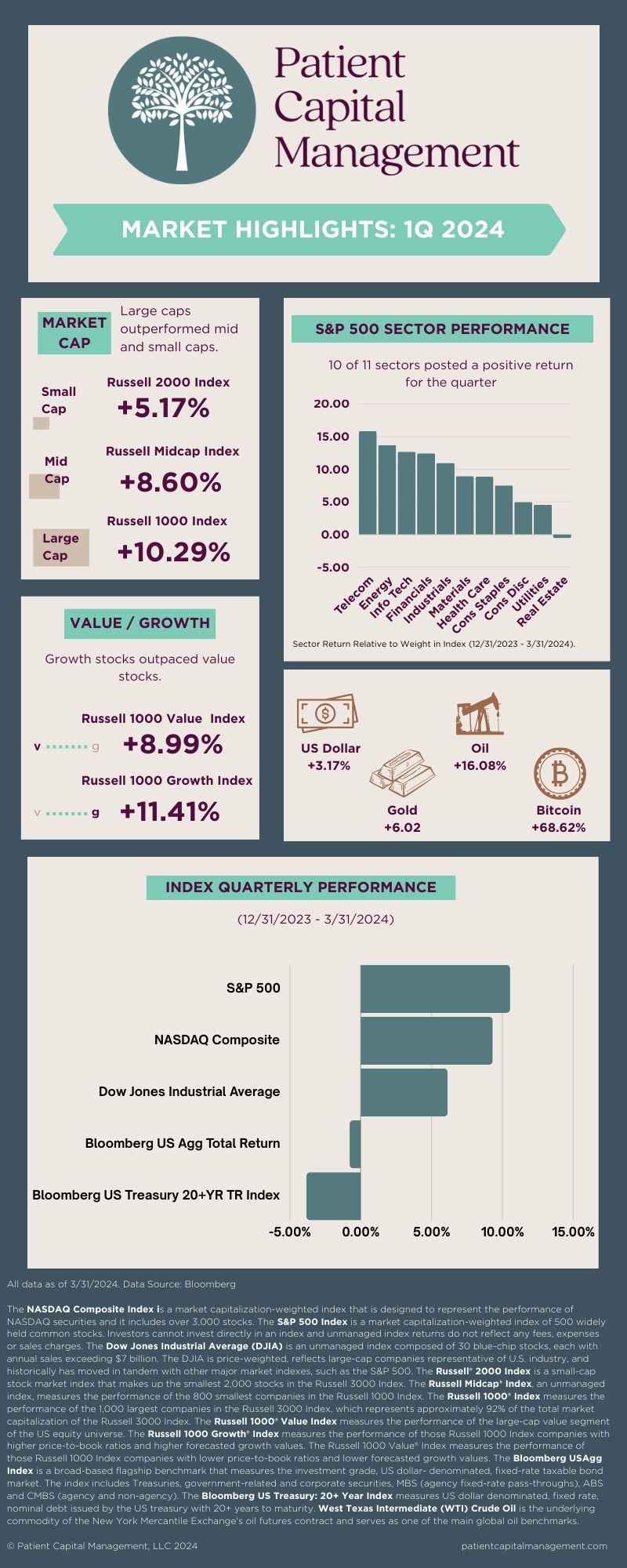

The S&P 500 led the way, gaining 10.6% followed by the Nasdaq Composite’s 9.3% return and the Dow Jones Industrial Average’s rise of 6.1%. Ten out of the eleven sectors in the S&P 500 posted positive returns for the quarter. The only sector to decline in the quarter was Real Estate, posting a decline of 0.6%. Telecommunications and Energy were the strongest performers in the quarter with gains of 15.8% and 13.7%, respectively.

Large-caps maintained their leadership outperforming both mid-caps and small-caps. The Russell 1000 gained 10.3% compared to the Russell Mid-Cap Index’s rise of 8.6% and Russell 2000 Index return of 5.2%. Growth continued its lead over value, with the Russell 1000 Growth Index climbing 11.4% compared to the Russell 1000 Value Index’s gain of 9.0%.

Bonds declined in the quarter, dramatically underperforming stocks, with US Corporates outperforming long-dated US Treasuries with the Bloomberg Aggregate declining 0.8% better than the -3.8% return of 20+YR Treasuries.

The US Dollar gained 3.2% in the quarter while Gold gained 6.0%. Commodities were higher, with West Texas Intermediate (WTI) crude gaining 16.1%. Bitcoin continued its impressive climb gaining 68.6% in the quarter and ending at a value of $70,845, marginally below its all time high of $73,157 seen two weeks earlier.

Data sourced by Bloomberg. Index data as of 3/31/24.

The NASDAQ Composite Index is a market capitalization-weighted index that is designed to represent the performance of NASDAQ securities and it includes over 3,000 stocks. The S&P 500 Index is a market capitalization-weighted index of 500 widely held common stocks. Investors cannot invest directly in an index and unmanaged index returns do not reflect any fees, expenses or sales charges. The Dow Jones Industrial Average (DJIA) is an unmanaged index composed of 30 blue-chip stocks, each with annual sales exceeding $7 billion. The DJIA is price-weighted, reflects large-cap companies representative of U.S. industry, and historically has moved in tandem with other major market indexes, such as the S&P 500. The Russell® 2000 Index is a small-cap stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. The Russell Midcap® Index, an unmanaged index, measures the performance of the 800 smallest companies in the Russell 1000 Index. The Russell 1000® Index measures the performance of the 1,000 largest companies in the Russell 3000 Index, which represents approximately 92% of the total market capitalization of the Russell 3000 Index. The Russell 1000® Value Index measures the performance of the large-cap value segment of the US equity universe. The Russell 1000 Growth® Index measures the performance of those Russell 1000 Index companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000 Value® Index measures the performance of those Russell 1000 Index companies with lower price-to-book ratios and lower forecasted growth values. The Bloomberg USAgg Index is a broad-based flagship benchmark that measures the investment grade, US dollar- denominated, fixed-rate taxable bond market. The index includes Treasuries, government-related and corporate securities, MBS (agency fixed-rate pass-throughs), ABS and CMBS (agency and non-agency). The Bloomberg US Treasury: 20+ Year Index measures US dollar denominated, fixed rate, nominal debt issued by the US treasury with 20+ years to maturity. The Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. West Texas Intermediate (WTI) Crude Oil is the underlying commodity of the New York Mercantile Exchange's oil futures contract and serves as one of the main global oil benchmarks. CPI: Consumer Price Index measures the monthly change in prices paid by U.S. consumers. Magnificent 7 is a group of stocks made up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (Magnificent 7 is a group of stocks made up of mega-cap stocks Apple (AAPL), Alphabet (GOOGL), Microsoft (MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA).MSFT), Amazon.com (AMZN), Meta Platforms (META), Tesla (TSLA) and Nvidia (NVDA). PCE: Personal consumption expenditures includes a measure of consumer spending on goods and services among households in the US. PCE, CPI, and inflation rates based on available data at the time the piece was written and are not guaranteed to stay the same in the future. M2 is the U.S. Federal Reserve’s estimate of the total money supply including all of the cash people have on hand plus all of the money deposited in checking accounts, savings accounts, and other short-term saving vehicles such as certificates of deposit (CDs).

The views expressed in this commentary reflect those of Patient Capital Management analyst(s) as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results.

©2024 Patient Capital Management, LLC

Share