The market vacillated between optimism of a soft-landing and fears of a recession as inflation data continued to trend lower while some weakness emerged in employment data. Headline CPI moved down to 2.5% in August, its lowest reading since March 2021, while US PCE 3-month annualized moved down to 2.1%. The unemployment rate hit a high of 4.3% in July before falling back to 4.2% in August. It’s still up 0.8% from the lows in January 2023.

The Federal Reserve brought relief late in the quarter cutting interest rates by 50bps to a range of 4.75-5.00%. This was the first rate cut since 2020 and the first 50bps rate cut, outside of COVID, since 2008. The Fed is forecasting an additional 50bps in cuts in 2024 while the market is expecting an additional 75bps by year-end.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

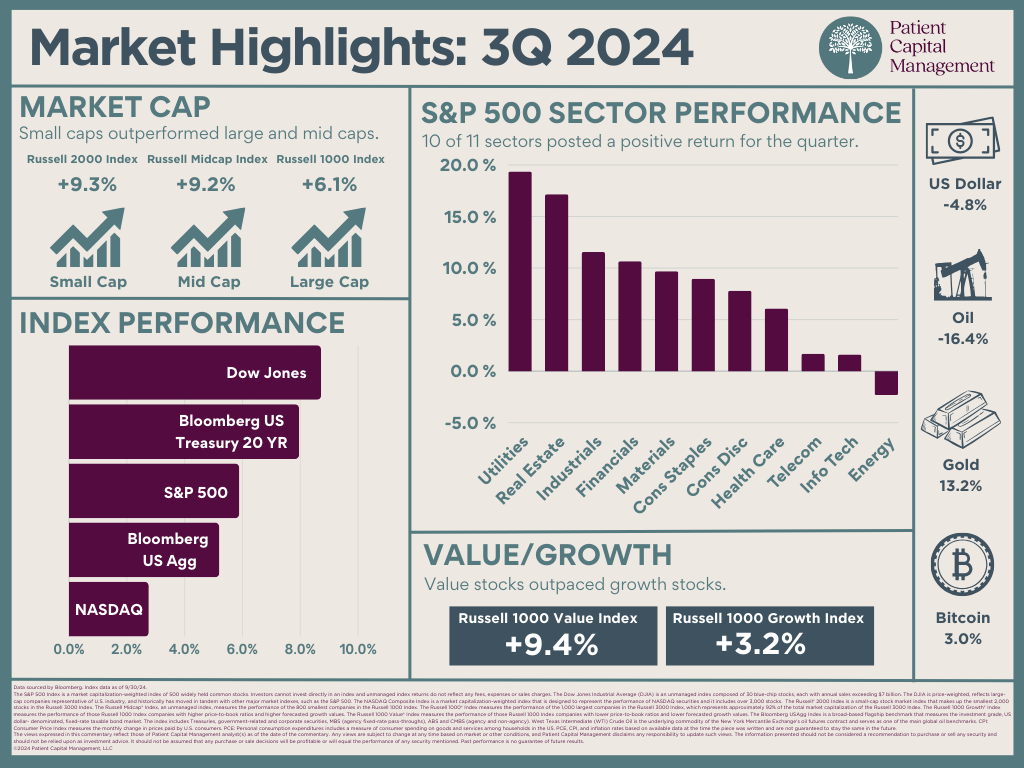

The Dow Jones Industrial Average lead the way gaining 8.7% followed by the S&P500’s 5.9% return and the Nasdaq Composites’ gain of 2.8%. Ten out of the eleven sectors in the S&P500 posted positive returns for the quarter. Utilities and Real Estate led the market with returns of 19.4% and 17.2%, respectively. Energy was the only sector to have a negative return losing -2.3%.

Small-caps reversed some of their year-to-date trend, outperforming both mid-caps and large-caps in the quarter. The Russell 2000 gained 9.3% while the Russell Mid-Cap Index returned 9.2% and the Russell 1000 Index posted returns of 6.1%. Growth underperformed value for the first time this year, with the Russell 1000 Growth Index rising 3.2% compared to the Russell 1000 Value Index’s climb of 9.4%.

Bonds improved in the quarter largely matching equity returns in the period. US 10-year Treasury yields fell from 4.4% to 3.8% in the quarter. Long-dated US Treasures were the standout performer gaining 8.0% ahead of US Corporates with the Bloomberg Aggregate returning 5.2%.

The US Dollar declined 4.8% in the quarter while Gold gained 11.5%. West Texas Intermediate (WTI) crude continued to fall declining -16.4% in the quarter and is down -24.9% YoY. Bitcoin continued to trade below the prior high seen in March but ended the quarter up 3.0% at $63,785.

Share