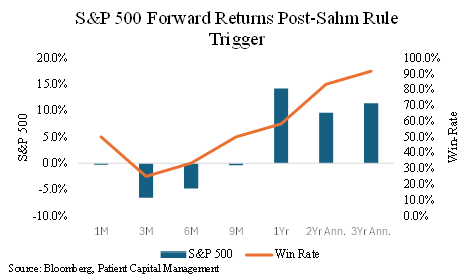

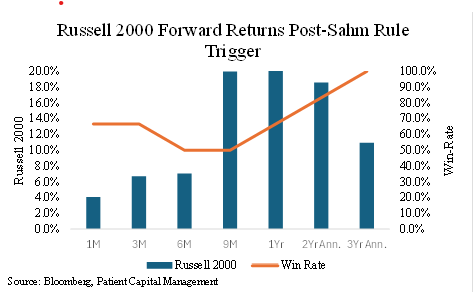

Recession fears loom large following several weak macro data points. After the Sahm rule was triggered this morning we analyzed what this has historically meant for markets. Historical forward returns for the S&P 500 have been negative in the short-term (-6.6% over the forward three-months and -4.8% over the forward six-months) with strong rebounds in the following 12-months and beyond (+14.2% 1yr +9.6% 2yr annualized +11.4% 3yr annualized). Interestingly small caps as measured by the Russell 2000 have outperformed the S&P 500 (+6.7% in the forward three-months and +7.0% in the forward six-months) a stark contrast from the ~300bps of underperformance we’ve seen in the past two trading sessions. The strong long-term returns with a high probability of success reinforce the idea that time not timing leads to wealth creation.

The employment data this morning triggered the Sahm Rule, a recession indicator that occurs when the three-month moving average of the national unemployment rate rises by 0.50% or more relative to the minimum three-month average over the prior 12-month period. The July unemployment rate rose to 4.3% this morning.

The Sahm Rule has a strong track record of signaling that the US is in a recession. On average a recession has started 4 months before the Sahm rule is triggered. There have been a few exceptions including December 1959 and October 1969 where recessions began a few months following the Sahm rule's move above 0.50 as well as the trigger in November 1976 that did not see a recession occur for another four years.

Is this time different? Only time will tell but there are a few considerations worth noting. Claudia Sahm herself wrote in a note last week that the Sahm rule is likely overstating the labor market’s weakening due to unusual shifts in labor supply. This is particularly true for the share of entrants to the labor force which is meaningfully outperforming typical recession readings and consistent with a higher unemployment rate due to increased labor supply from immigration. Second, Gavekal noted that recent ADP payrolls and job openings are consistent with a weaker not collapsing US labor market that resembles more of a softening than a recession.

What are the implications for the equity market once the Sahm Rule has been triggered? Forward returns for the S&P have historically struggled in the near-term with a median decline of -6.6% and -4.8% in the following three- and six-month periods respectively. For comparison the current 2-day selloff in the S&P is -3.5%. Remaining patient; however paid off with 1yr forward median returns of +14.2% (58% win rate) 2yr annualized median returns of +9.6% (83% win rate) and 3yr annualized median returns of +11.4% (92% win rate).

Interestingly, small-caps as measured by the Russell 2000 since 1979 performed better than the S&P 500 once the Sahm Rule was triggered, outperforming the S&P 67% of the time in the following three-month period with median returns of +6.7% and 83% of the time in the following six-month period with median returns +7.0%. Longer-term returns are quite favorable at +27.4% in the trailing 1yr period (67% win rate and outperforming the S&P 100% of the time), +18.6% annualized in the forward 2yr period (83% win rate and outperforming the S&P 83% of the time) and +11% annualized in the forward 3yr period (100% win rate and outperforming the S&P 67% of the time).

It’s impossible to predict the future. Historical context can provide insight and a long-term perspective significantly lowers risk. We focus on being patient, flexible, and long-term investors. Time not timing leads to wealth creation.

Sources: Bloomberg, Claudia Sahm, Gavekal Research, and Patient Capital Management

- Claudia Sahm: https://stayathomemacro.substack.com/p/sahm-thing-more-on-the-sahm-rule

- Gavekal Research, the Daily August 2 2024 “The Root Cause of Summer Reductions”

- Win-Rate: percentage of time the market was higher in noted forward period

Share