“Always remember, your focus determines your reality.” — George Lucas

We’ve officially entered bear market territory! Investor angst has rarely been greater. It’s nearly impossible to find someone with a positive take on the toxic brew of elevated inflation, Central Bank tightening and a potentially looming recession.

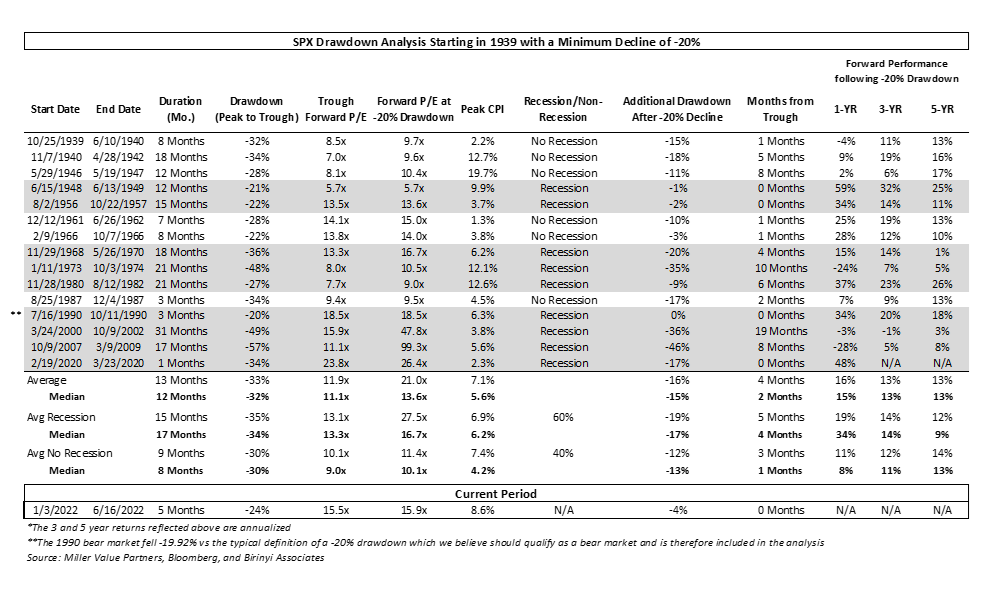

Well, here’s the positive take. Based on history, evidence overwhelmingly points to great market returns over the next 1, 3 and 5 years, whether or not we have a recession! Historically, after entering bear market territory, the market averaged mid-teens returns over the next year and low-teens returns per year over the next 3-5 years!

We’ve already suffered immense pain with the S&P 500 down ~24% peak-to-trough, clearly well into bear market territory (usually defined as losses greater than 20%). We looked at all historical bear markets since the Great Depression for clues on what to expect from here.

The bad news is that judging from history, everyone is correct that we could see more downside in the short term. Once the market dropped 20%, there was an average additional downside in the mid-teens percentages. That roughly brings us to 3300 on the S&P 500, ~13% downside from where we currently sit (3785). It could take approximately 2-4 months to reach that point. Yikes! No one wants that… but wait!

Here’s the really good news! Most of the time, longer term returns from here are strong! Once you have a 20% drawdown, based on historical performance, you have high odds of earning strong returns over the next 1, 3 and 5 years! On average, the market gains 16% over the next year and 13% annually over the next 3-5 years (including any additional losses).

But wait, you say… that can’t possibly be true if we have a recession. Actually, it’s still absolutely true! If we just look at the subset of bear markets that included recessions, the forward returns are in fact stronger! As illustrated in the table above, historically, after entering a bear market, the market returned 19% on average over the next year when there’s a recession. Over the next 3-5 years, the market earned 12-14% per year on average. Granted, there is somewhat more downside in the short-term and it takes longer to bottom, but you can more than make up for it on the other side. (Note: it’s good to buy low even when it feels terrible!). Even with recessions, you had large gains over the 1-year period 2/3 of the time.

The recession scenarios also contained the worst-case outcomes. There were only two instances of significant additional declines (greater than 5% further losses) and both were triggered by severe recessions.

One was the Financial Crisis (07-09). We can safely rule out that scenario now given sterling bank balance sheets and solid credit underwriting standards.

The other nasty period was the 1973-1974 bear market. During that bear market, you lost an additional 24% over the next year. Pretty terrible. Unfortunately, we can’t rule out this kind of scenario given the similarities of heighted inflation, soaring oil prices due to geopolitical risks and elevated valuations at the onset of the period. This speaks to the current risk.

It’s important to note that during this 70’s period, the market bottomed when inflation peaked. This clearly explains why the market reacts so fiercely to any sign inflation is peaking or not. So goes inflation, so goes the market. Even during the 73-74 bear market, after entering bear market territory, the forward 3- and 5-year returns were 5-7% per year. That falls well below the typical experience, but for one of the worst-case scenarios, it ain’t that bad!

As to other risks, I would also note that the worst 3- and 5-year returns were after the tech bubble burst in the early 2000’s. The S&P 500 posted returns of (1)%-3% per year over 3-5 years. Note: there’s absolutely no precedent for losing money over the 5 years after entering a bear market, wow! But zero returns stink, especially in an inflationary environment. The lackluster results in the early 2000’s came from enormous losses in tech and telecom, which were massively overvalued. There were plenty areas of the market that were more reasonably valued, and actually did much better. A valuation focus provided significant protection.

The conclusion: patience is a virtue! The long-term prospects actually look pretty good, at least based on history and evidence. The biggest risk of all might be our own instinct to react to short-term fears rather than long-term evidence.

The market returns presented above utilize the S&P 500 Index returns as a proxy for general market returns.

The views expressed in this report reflect those of the Miller Value Partners strategy’s portfolio manager(s) as of the date published. Any views are subject to change at any time based on market or other conditions, and Miller Value Partners disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results.

©2022 Miller Value Partners, LLC

Share