I’ve been reflecting on lessons I’ve learned from Bill Miller. During a recent chat, I asked him what was the most important one. He replied quoting Jesse Livermore, “the big money is made in the big moves.”

Bill is a master at finding securities with the potential for huge gains. He’s also uniquely qualified at holding them, which is BY FAR much harder! That’s because the biggest winners suffer severe drawdowns on the wealth creation journey.

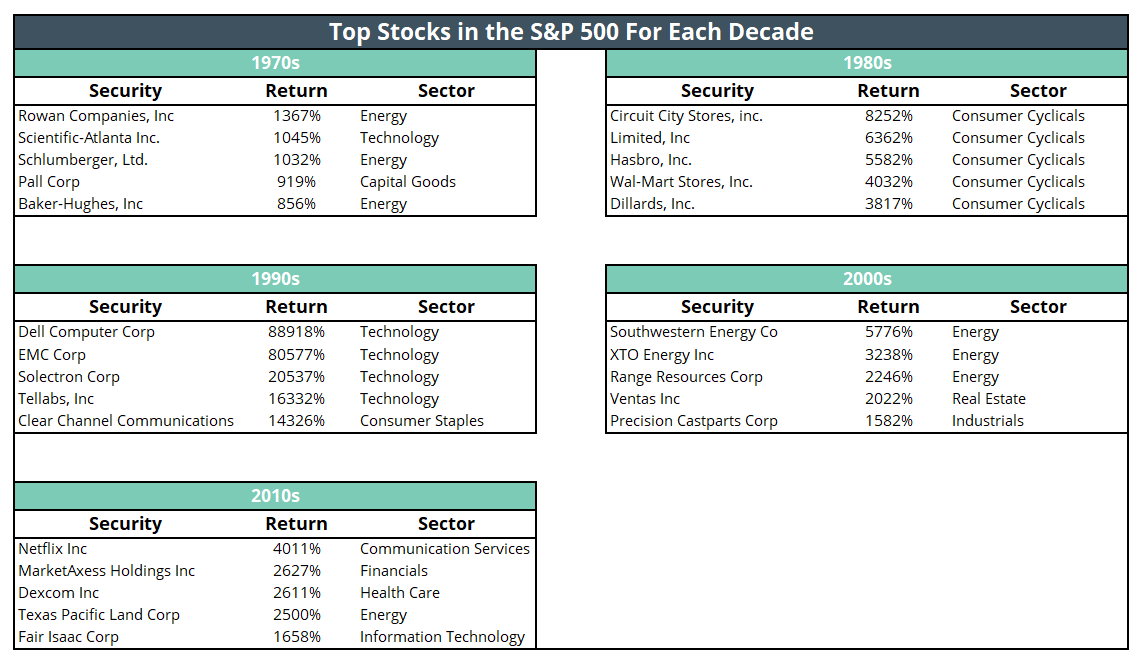

Dell, Microsoft, and Cisco were all up more than 10,000% in the 90s, yet virtually no investors made 100x. We’ve long tracked the top performers of each decade. In the 1970s it was oil and hard assets, then consumer products in the 1980s, technology in the 1990s, then global cyclicals in the 2000s.

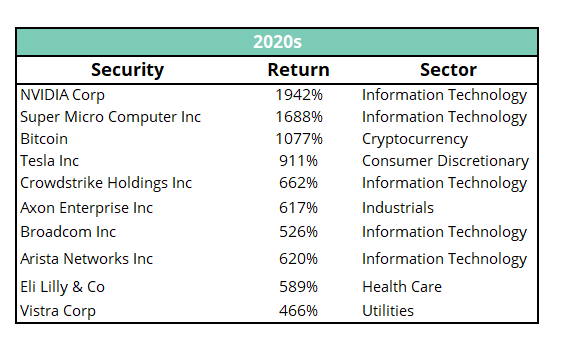

We decided to check the biggest winners of this decade so far. Tech is winning with AI a big theme. Since 2019, the top three performers in the S&P 500 are Nvidia Corp (NVDA 1,942%), Super Micro Computers (SMCI 1,688%), and Tesla (TSLA 911%). Bitcoin would place third on this list, climbing 1,077% since 2019.

We decided to check the biggest winners of this decade so far. Tech is winning with AI a big theme. Since 2019, the top three performers in the S&P 500 are Nvidia Corp (NVDA 1,942%), Super Micro Computers (SMCI 1,688%), and Tesla (TSLA 911%). Bitcoin would place third on this list, climbing 1,077% since 2019. Over the past 5 decades, the S&P 500’s best stock has returned 21,655% on average with a 5,766% median. If Nvidia accomplishes this performance level, it would imply prices of $1,280.32 (966% upside) and $345.64 (188% upside) respectively. The S&P 500’s third best stock over the past 5 decades has returned 6,401% on average with a 2,428% median. For Bitcoin, this would imply prices of $465,393.71 (452% upside) and $180,975.93 (115% upside), respectively.

Over the past 5 decades, the S&P 500’s best stock has returned 21,655% on average with a 5,766% median. If Nvidia accomplishes this performance level, it would imply prices of $1,280.32 (966% upside) and $345.64 (188% upside) respectively. The S&P 500’s third best stock over the past 5 decades has returned 6,401% on average with a 2,428% median. For Bitcoin, this would imply prices of $465,393.71 (452% upside) and $180,975.93 (115% upside), respectively. No one knows what the future prices of Nvidia, Bitcoin or anything else will be. We do know that investors systematically sell their winners too soon. Patience is the key to compounding.

Data source: Bloomberg and Patient Capital Management

The views expressed in this commentary reflect those of Patient Capital Management analysts as of the date of the commentary. Any views expressed are subject to change at any time, and Patient Capital Management disclaims any responsibility to update such views. There is no guarantee that market trends discussed herein will continue. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned.

Content may not be reprinted, republished or used in any manner without written consent from Patient Capital Management.

The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice.

Past performance is no guarantee of future results.

©2025 Patient Capital Management, LLC

Share