The far bigger obstacle to successful investing and weight loss is behavioral. Both require impulse-control and personal fortitude. When your energy level drops late afternoon and your colleague offers you a soft, home-made chocolate chip cookie, you know you should say no but one little bite doesn’t have too many calories. Except before you know it, you’ve eaten the entire cookie and you’re contemplating number two. Likewise, most people know they can’t time the market successfully but after watching their account value drop 20%, they can’t resist the urge to sell to stop the pain. The problem is that bottoms are made of exactly those emotional behaviors. The market bounces and the decision to sell made permanent losses out of temporary volatility.

Basic human emotion and experience drive behavior in both situations. Those driving forces remain constant through time. It’s useful to step back and ask where we see these forces in today’s markets.

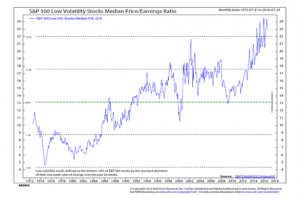

The market’s sordid love affair with “stability” is one example. The lowest volatility stocks in the market are the most expensive they’ve been in the past 40-plus years (see chart). At the same time, their growth outlook is the most bleak. Behaviorally, this can make sense. Investors suffered through a nasty secular bear market. From the peak in March 2000 to the trough in March 2009, the market lost more than 42%. It’s highly unusual for the market to lose so much over such a long period. Investors were traumatized. The lesson: protect your money at all costs! That’s exactly what we’ve seen.

Used with permission from Ned Davis Research and S&P Compustat.

Investors have placed a much larger premium on not losing money than on making money. Amazingly, value stocks and stable stocks are “at war” in the words of Empirical Research’s Michael Goldstein. For the past year, the relative returns of value stocks have been inversely correlated with stable stocks. People flock to areas where the odds of losing money are the lowest at any sign of turmoil. This is entirely logical given the shared experience of the much greater than normal losses during the secular bear market. However, it is exactly this behavior that is creating an inflated risk of loss.

Consumer staples companies trade at 22x annual earnings, 25% higher than the average multiple over the past decade, more than any other group. Proctor & Gamble (PG) and Coke (KO) trade for price-to-earnings multiples (~23x) much higher than the market (18x) with much worse revenue growth (declines for Coke as far as the eye can see, low single digit for PG). People own these names for stability and yield, as both have dividend yields between 3.0-3.3%. Payout ratios are already high at close to 80% so it’s hard to see where incremental gains come from. If the perception of stability erodes, there will be lots of disappointed holders looking for the exit.

People always do what they should have done in the past. During times of greater than average losses and volatility, stability pays well. We see a similar phenomenon in bond land. In fact, the massive decline in interest rates could be one reason stable companies have done so well. Correlations between bonds and stable stocks have risen to close to 60%.

Bonds have experienced one of the greatest bull markets of all times. Since the beginning of 2000, long term treasury bonds are up 8.3% per year on average, a solid long-term return especially for a risk-free security! The maximum drawdown was about 18%. Compare this to equities. Over the same period, the S&P 500 has compounded at an average annual rate of 4.2% with a maximum drawdown of 55%! Who would ever choose the latter over the former? Exactly, NO ONE!

Investors have pulled nearly a whopping $900B from active US equity funds since 2006! Some of this has gone into passive strategies but much of it has gone into bonds! With long-term risk free rates in many developed markets hovering between 0% and 2%, the outlook for returns from here is very different than the past. With $11T in bonds yielding less than 0%, people clearly aren’t focused on maximizing wealth.

An interesting new academic paper took a look at whether the frequency professional traders look at the market impacts their long-term results. Unsurprisingly, professional traders who saw more market gyrations exhibited greater loss aversion, investing less and doing worse. Those who saw the most infrequent price information earned profits more than 50% higher over a mere two week period! The implication is that short-term losses that represent pure noise inflict a great long-term cost.

You can clearly see that phenomenon playing out as people flock towards private markets over public ones. Bill Gurley, one of the most successful venture capitalists we know, has been quite vocal about the misallocation of capital toward venture investments. In his opinion, many business models out there are unsustainable and many private valuations are inflated. Gurley says you can sell a dollar for $0.85, make a lot of revenue and please your customers, but it’s not sustainable. Historically, venture funds have earned higher returns than the public equity market with less volatility since investments aren’t “marked to market” in the same way. People don’t experience the downside volatility so it feels much better. Given the current conditions though, it’s faulty to assume past returns are representative of the future.

Public markets enforce discipline on companies. A number of our companies’ managements have served as both public and private company executives. Many of them have told us there are different standards for public companies than private. Public markets require less leverage, greater attention to the profitability of the business and higher reporting standards. All of these differences would serve to lower risk (possibly at the expense of long-term returns). Since investors currently seem to prefer lower risk to higher return, this should favor public markets but asset allocations and flows suggest the opposite.

The great irony is that extreme aversion to loss and volatility seems to be causing people to take extreme risks. Investing in sovereigns bonds earning zero or less won’t end well. No one knows when that party will end, but you aren’t paid enough to take that risk. Likewise, allocating money to inflated venture companies seems highly risky and the valuations of stable companies don’t compensate for the risk. The good news is that there are still plenty of opportunities to make money in this market.

Behavioral anomalies create opportunities. We think the current environment offers significant wealth creation opportunities if you have the patience to hold for the long-term, the discipline to adhere to a valuation-based framework and the independence and conviction to go against the crowd. That’s what we’re focused on.

The views expressed in this report reflect those of the author as of the date of the report. Any views are subject to change at any time based on market or other conditions, and LMM disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results, and there is no guarantee dividends will be paid or continued.

©2016 LMM LLC. LMM LLC is owned by Bill Miller and Legg Mason, Inc.

Share