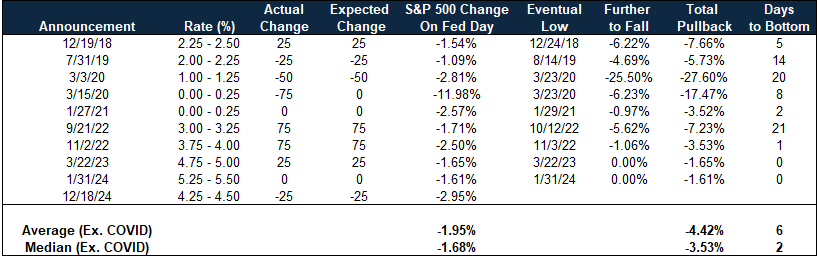

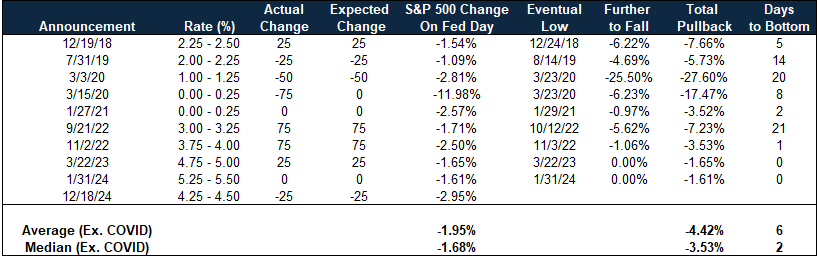

Yesterday, the S&P 500 had its second worst day of the year, selling off -2.95% on the back of Powell’s increased caution around further rate cuts next year. The VIX spiked 74%, recording its second largest increase of all time. Pullbacks are normal and natural, but never feel that way. Was yesterday a harbinger of worse to come or have we seen the lows? To better understand what this knee jerk reaction implies, we looked at historic Fed disappoints since 2018. We found the pain is typically short lived. On the day of the disappointment, excluding COVID, the S&P 500 has fallen -1.95% on average (-1.68% median). The total pullback has been -4.42% on average (-3.53% median) and lasted 6 days on average (2 days median). Since 2023, the market has bottomed on the day of the Fed announcement and only moved higher from there. The biggest exceptions were in COVID with the ensuing recession, which we see as lower relevancy. So far today as we write this, the market is up, which is a good sign. When that happened historically (outside of COVID), we only saw 0-1% further losses. We are reminded of Edwin Lefevre’s famous quote in Reminiscences of a Stock Operator, "Well, this is a bull market, you know!" No changes to our assessment of that yet.

Data source: Birinyi and Patient Capital Management

The views expressed in this commentary reflect those of Patient Capital Management analysts as of the date of the commentary. Any views expressed are subject to change at any time, and Patient Capital Management disclaims any responsibility to update such views. There is no guarantee that market trends discussed herein will continue. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned.

Content may not be reprinted, republished or used in any manner without written consent from Patient Capital Management.

The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice.

Past performance is no guarantee of future results.

© 2024 Patient Capital Management, LLC

Share