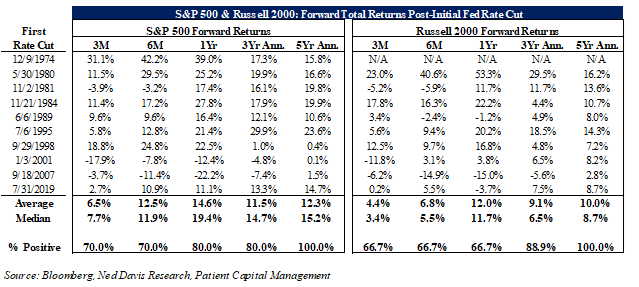

Market performance post-initial Fed rate cut has historically been strong. In the ten easing cycles since 1974, the S&P 500 on average returned +14.6% in the forward 1Yr period, +11.5% annualized in the 3Yr period, and +12.3% annualized in the 5Yr period. The Russell 2000 on average returned +12.0% in the 1Yr period, +9.1% annualized in the 3Yr period, and +10.0% annualized in the 5Yr period. The S&P 500 outperformed 67% of the time in the 1Yr and 5Yr periods and 55% of the time in the 3Yr period. In all the cycles we analyzed, increasing your time horizon improved your probability of success with the S&P 500 and Russell 2000 up 100% of the time in the 5Yr period.

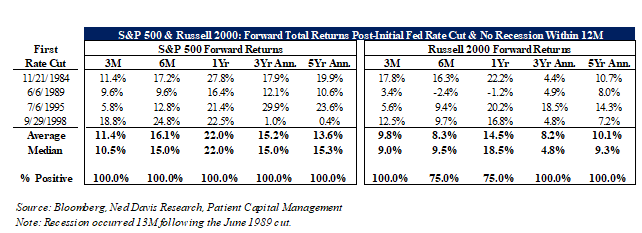

Easing cycles not associated with recessions within 12 months experienced the best forward returns. Since 1974, 40% of Fed easing cycles have not corresponded with a recession within 12 months. Interestingly, 4 of the last 7 cycles, or 57% of the time since 1984, have not corresponded with a recession within 12 months. Returns in these periods have been quite strong with the S&P 500 and Russell 2000 +22.0% and +14.5%, respectively, in the forward 1Yr period. The S&P 500 outperformed the Russell 2000 100% of the time in the forward 1Yr period and 75% of the time in the 3Yr and 5Yr periods.

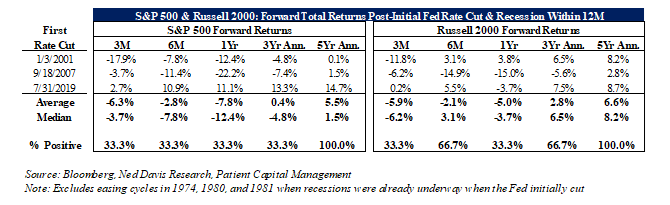

Forward returns post-first cut that correspond with a recession within 12 months pose a risk, though are still positive 100% of the time in the 5Yr period. Markets have generally struggled when a recession occurs within 12 months of the initial cut with the S&P 500 on average -7.8% in the forward 1Yr period and the Russell 2000 -5.0%. While the sample size is small, the data suggests large-caps tend to outperform in the 3-6 month period post-initial cut and underperform in the forward 1Yr, 3Yr, and 5Yr periods. Again, extending your time horizon materially improves the probability of success with both large- and small-caps posting positive returns 100% of the time in the 5Yr period.

1 Win-Rate: percentage of time the market was higher in noted forward period

The views expressed in this commentary reflect those of Patient Capital Management analyst(s) as of the date of the commentary. Any views are subject to change at any time based on market or other conditions, and Patient Capital Management disclaims any responsibility to update such views. The information presented should not be considered a recommendation to purchase or sell any security and should not be relied upon as investment advice. It should not be assumed that any purchase or sale decisions will be profitable or will equal the performance of any security mentioned. Past performance is no guarantee of future results.

©2024 Patient Capital Management, LLC

Share